Intel's release of an AI chip to challenge Yvetteda.

On the eve of the announcement of America’s heavy weight CPI tonight, the US stock continued its prudential trade sentiment of the previous days, with three major indices rising and falling, pointing to a two-faced, pamphlet, and a small rise in fingernails. Investors wanted to learn more about inflation in the United States through the CPI and to use it to determine the Fed’s path to interest reduction. As of the closing, the standard 500 index rose by 0.14 per cent, reporting point 5209.91; the Dow Jones index fell by 0.02 per cent, reporting point 38883.67; the NASDAQ index rose by 0.32 per cent, reporting point 16306.64.

In terms of the rate of return on US debt, the ten-year rate of return on US debt fell back from a week-long high of 4.36%, and the two-year rate of return on US debt, which is the most sensitive to US Federal Reserve policy interest rates, was 4.74%. The US March CPI data will be released tonight at 20:30 Beijing time, with economists expected to fall 3.4% compared to 3.2% in February, while the ring will rise 0.3%.

The market’s probability of reducing interest rates starting in the first half of the year has been revised downwards as a result of successive falcons by Fed officials, while the alternate night Fed Chairman of Atlan ta, Bostik, reiterated this year’s expectation that interest rates would be reduced only

ta, Bostik, reiterated this year’s expectation that interest rates would be reduced only  once. However, he added that if the economic

once. However, he added that if the economic situation changed, he would be open to delays or further interest cuts.

situation changed, he would be open to delays or further interest cuts.

The Fed faces a number of challenges in opening the path to interest-rate reduction. In the important news of the other night, gold is the most recent absolute market player, with spot gold rising by nearly 1.2% in the early years of Europe, rising by nearly US$ 2360 to US$ 2365.

World Gold Council states in a report that “the fundamentals underpinning the current rise in gold prices include increased geopolitical risks, stable purchases by central banks, and the elastic demand for jewellery, gold bars and gold coins.” O n the business side, Intel released its latest artificial intelligence chip (AI) Gaudi 3, which is expected to be marketed widely in the third quarter.

n the business side, Intel released its latest artificial intelligence chip (AI) Gaudi 3, which is expected to be marketed widely in the third quarter.

Intel claims that the new Gaudi 3 chip repr esents an average increase of 50% in reasoning, an average increase of 40% in energy efficiency, and a 1.5-fold increase in the speed with which an artificial intelligence model is operating. Intel says that the product will be roughly the same as the latest H200 in the country, and even better in some areas.

esents an average increase of 50% in reasoning, an average increase of 40% in energy efficiency, and a 1.5-fold increase in the speed with which an artificial intelligence model is operating. Intel says that the product will be roughly the same as the latest H200 in the country, and even better in some areas.

Google announced the launch of a data centre chip, called Axion, based on the Arm architecture, at its annual cloud computing conference this year. Google plans to provide this CPU through Google Cloud, claiming that it has more performance than the X86 structure chip and the generic Arm architecture chip operating on the cloud. The Axion chip is 30% higher than the generic Arm chip and 50% higher than the current generation produced by Intel.

-

Previous

Apple release multi-model model Ferret-UI, partial cell phone UI mission beyond GPT-4V

The birth of the big model, which led tech giants and entrepreneurs to shoot again in a new round of competitions, and the rise of entrepreneurial stars such as OpenAI, Anthropic, and Mistral prove

-

Next

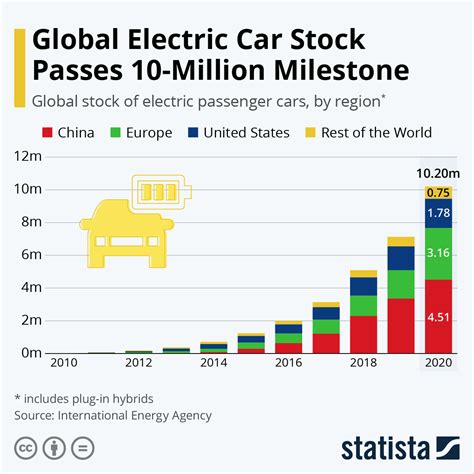

The weak sales of electric vehicles in North America has led to the downgrade of Sensata ST.US and ChargePoint CHPT.US ratings in Goldman Sachs.

This year, US electric vehicle sales slowed and competition intensified, affecting not only the original equipment manufacturer (OEM), but also suppliers. In this environment, Goldman Sachs downgra

Related articles

- The TCU dropped 1.2% last week.

- Fast-trackers dropped 4.17% of Hong Kong stock last week.

- Google recorded a 2.61% increase in US shares last week, and JMPSecurities rated the winning board.

- Peng fell 10.08% of Hong Kong's share last week.

- Three shares of futures are rising by almost 10%.

- The ideal car went up 8.36% last week, and the stock of Hong Kong went up 4.56%.

- Ali Baba fell 3.37% of the stock in Hong Kong last week by 7.09%.

- Three shares mean that futures are rising and falling by more than 7%.

- Three shares indicate that futures are down in Inhibrx up by over 6%.

- We're looking forward to a two-way drop in the stock of the United States, and we're looking forward to a new high in the stock of Ying Weida.