Three major shares indicate that each Snap fell by more than 30%.

The US shares have fallen by 0.09% on futures up to the time of the release, the blue-based index; the standard 500 index futures have fallen by 0.09%; and the technology-based NASDAQ 100 index futures have risen by 0.02%. The popular stock market has gone low, with the DAX index in Germany falling by 0.39% at the time of the submission; the CAC 40 index in France has fallen by 0.19%; and the 100 index in the UK has fallen by 0.46%.

The Fed’s speech and changes in employment data expected uncertainty to re-emerge in the US debt market, after renewed attention to the likely timing of the F ed’s interest reduction, is causing volatility in the fixed-income market, which is increasing risks for investors who will continue this year with their bets on the explosive rebound that pushed their bonds up by the end of 2023. While investors still predict a number of interest cuts in the Fed this year, they are not sure when and how much interest rates will fall in the Fed, and concerns about the anticipated surge in government bond issuance have weakened the enthusiasm.

ed’s interest reduction, is causing volatility in the fixed-income market, which is increasing risks for investors who will continue this year with their bets on the explosive rebound that pushed their bonds up by the end of 2023. While investors still predict a number of interest cuts in the Fed this year, they are not sure when and how much interest rates will fall in the Fed, and concerns about the anticipated surge in government bond issuance have weakened the enthusiasm.

[Corporate News] The fall in oil prices has led to a loss of profit in Total Q4 that is expected to raise dividends to save investors. The financial statements show that Q4 received $54.765 billion, a 14 per cent decline compared to the previous year, higher than the market forecast of $49.730 billion; net profit of $5.063 billion, a 55 per cent increase compared with the same year; adjusted net profit decreased by 31 per cent to $5.23 billion compared to the analyst's average projection of $5.66 billion; and after-sales income per share was $2.16 compared to $297 compared with the market forecast of $234 for the same period the previous year.

In a Tuesday’s report, Moody wrote that community banks in New York were facing multiple financial risks and governance challenges, and Moody transferred the company’s long-term issuer’s rating down to two levels from the investment level to Ba2. According to the rating firm, if the situation deteriorates, it may further downgrade the rating.

Woodside and Santos ended potentially large merger negotiations with a total market value of approximately $57 billion. Woodside and smaller rival Santos Ltd. concluded negotiations on a potential merger that could have created an Australian gas exporter but was blown off by the failure of the parties to agree on a valuation.

It is understood that the inclusion of Santos’ portfolio would have made Woodside one of the largest LNG producers in the Asia-Pacific region. However, the executives warned that any agreement would need to take into account lower premiums in other major recent oil and gas transactions. The financial statements show that EquinorQ4 earned $8.75 billion in operating profits, a decline of 47 per cent over the same period, but better than the market forecast of $8.46 billion; and $1.88 billion after tax profits, a decline of 60 per cent over the same period. The significant decline in the company's Q4 profitability was mainly due to a significant fall in natural gas prices.

A document of the United States Securities and Exchange Commission (SEC) shows that the “economist” who bought 4.3 million shares of Western oil at a price of approximately $245 .9 million in recent days, w

.9 million in recent days, w ith an average share price of $57.15. According to the information received, Birkhshir Hasawe currently holds about 248 million shares of Western oil at an average value of about $14 billion.

ith an average share price of $57.15. According to the information received, Birkhshir Hasawe currently holds about 248 million shares of Western oil at an average value of about $14 billion.

The Amazon health sector will be retrenched by hundreds of people, and the Amazon will be retrenched by hundreds of people in its health sector, further reinforcing the company’s cost-cutting efforts. Neil Lindsay, head of the Amazon health service, announced on Tuesday that the layoffs would affect the “Fade of Positions” between the OneMedicamal office and the company’s online pharmacy business, which was acquired by the Amazon last year.

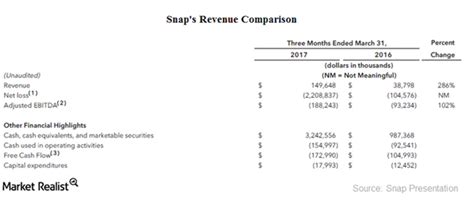

Owing to the continuing low market for digital advertising, the SnapQ4 harvest was disappointing, and guided the losses in the first quarter of 2024 by far more than the analysts expected. The financial statements show that the SnapQ4 harvest increased by 5 to 1.36 billion dollars on a year-on-year basis than the analysts expected by an average of $1.38 billion.

The net loss of $248 million was lower than the analyst's average projected loss of $287 million, compared with a net loss of $288 million for the same per iod in the previous year; the adjusted interest tax depreciation pre-amortization profit (EBITDA) was $159 million, a 32 per cent decrease over the same period; and the adjusted return per share was $0.08, a 43 per cent decrease over the same period, better tha

iod in the previous year; the adjusted interest tax depreciation pre-amortization profit (EBITDA) was $159 million, a 32 per cent decrease over the same period; and the adjusted return per share was $0.08, a 43 per cent decrease over the same period, better tha n the analyst's average forecast of $0.06.

n the analyst's average forecast of $0.06.

-

Previous

The U.S. share fell by 163 during the night and Ali Baba responded that it was still an important asset.

In the rest of the night, the U.S. share of the U.S. shares rose by 0.82 per cent, the P. 500 index rose by 4995.06, the NASDAQ composite index rose by 0.95 per cent, the 15756.64, the Dow Jones in

-

Next

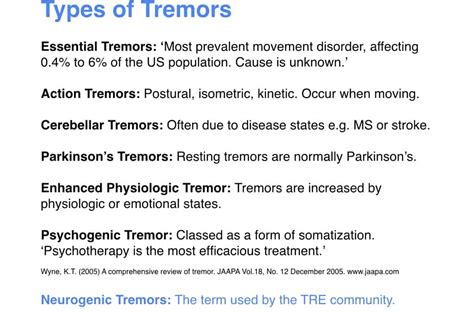

It's an exponential rise in a tremor! How can a diet cure a fat liver?

On Tuesday, 6 February, the United States dollar as a whole was not volatile, and the market needed some time to absorb a large number of financial performances and the near-devastated dream of a f

Related articles

- Fast-trackers dropped 6.67% of Hong Kong stock last week.

- Fast-trackers dropped 4.17% of Hong Kong stock last week.

- Microsoft showed an increase of 1.8% in the US share last week, and Wells Fargo gave it a higher rating.

- More like last week, the share of the United States rose by 2.32 per cent.

- The accumulated net profit in the first three quarters of the year increased by 11.01 per cent.

- U.S. stock bounces back the chip and wins the big game, and the silver market sees the apples rise by over 3%.

- A total of 134 U.S. shares went up the other night, saying Ma Yun became the largest shareholder in Ali Baba.

- A strategic cooperation framework agreement was signed last week between the Association for the Development of Prefabricated Vegetables Industry and the Gyeongdong Group, with a total of 203 Chinese general shares falling in Shanghai.

- The U.S. share fell by 0.14% last week, and the stock of Hong Kong fell by 3.76%.

- Three shares indicate that the future fell by more than 11% in Intel.