CVC Capital will launch its IPO tomorrow, with a global asset management scale of 186 billion euros, making it the largest listed private equity firm in European history.

Accordi ng to the Financial Times, European private equity group CVC Capital Partners is preparing to announce its initial public offering (IPO) pla

ng to the Financial Times, European private equity group CVC Capital Partners is preparing to announce its initial public offering (IPO) pla n as early as next Monday (tom

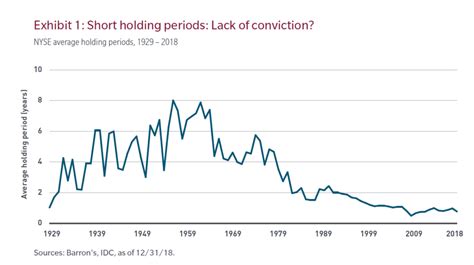

n as early as next Monday (tom orrow), kicking off one of the most anticipated listings on the European continent this year. As CVC prepares for its IPO, IPO and transaction activities have seen a broader rebound after two years of slowdown. As of the time of writing, representatives from CVC have not made any comments. Headquartered in Luxembourg, CVC manages assets worth €186 billion, with the majority being used for its private equity strategy.

orrow), kicking off one of the most anticipated listings on the European continent this year. As CVC prepares for its IPO, IPO and transaction activities have seen a broader rebound after two years of slowdown. As of the time of writing, representatives from CVC have not made any comments. Headquartered in Luxembourg, CVC manages assets worth €186 billion, with the majority being used for its private equity strategy.

The group has gained significant reputation by acquiring stakes in well-known brands such as Debenhams, Formula One racing, and PG Tips tea manufacturer. This European private equity giant is seeking a valuation of over $15 billion for its IPO. It is worth noting that the market values of peers such as Blackstone and KKR have experienced significant increases in the past few months, which also bodes well for CVC to secure an attractive valuation. CVC Capital is working with Goldman Sachs, JPMorgan Chase, and Morgan Stanley to plan for the IPO.

This long-established European private equity firm, if successful in listing, will become the largest listed private equity institution in European history. It is reported that CVC first appeared in 1981, with its earliest history dating back to a venture capital project established by Citigroup in 1968. In 1993, CVC was acquired by its management team and became an independent investment firm headquartered in Luxembourg. After years of development, CVC has be come one of the world's largest private equity funds.

come one of the world's largest private equity funds.

CVC Capital is known as one of the European giants in the private equity industry, with assets under management totaling 186 billion euros (approximately 1.4327 trillion RMB) to date. According to its official website, CVC Capital currently has offices in Shanghai and Hong Kong, with a total of nearly 30 employees. In February of this year, CVC Capital successfully completed the fundraising for its sixth Asia-Pacific fund, raising a total of 6.8 billion US dollars, equivalent to 49.2 billion RMB. This brings the total assets under management of CVC's Asia-Pacific fund to over 21 billion US dollars.

It is understood that the sixth phase of the CVC Asia Pacific Fund will focus on controlling, joint controlling, and cooperative investments in high-quality enterprises in the core consumer and service sectors in Asia. Since 1999, CVC has been active in the Asian market and has completed more than 80 investments in Asia. In July 2023, CVC announced that it had raised 26 billion euros (approximately 200.2 billion RMB) for its ninth M&A fund, setting a record for the largest M&A fund in history.

The fund announced the start of fundraising at the beginning of 2023, with an initial target of 25 billion euros, but eventually raised more than the original target. Reports suggest that the record-breaking fundraising amount may further support CVC's listing plan. According to Caixin, CVC had previously sold a small portion of its equity to Dyal Capital under Blue Owl in 2021, with an estimated valuation of around 15 billion US dollars. Based on this estimate, CVC's listing is not only set to be the largest IPO in Europe this year, but also the largest listing of a private equity firm in European history.

In addition, according to foreign media reports, CVC's IPO this time is different from those of  Blackstone, KKR, and Carlyle that went public earlier. The listing framework of CVC Capital will reference the model of the Swedish investment firm EQT, where equity investors can share all management fee income, but most of the profits from private equity transactions will not be openly shared.

Blackstone, KKR, and Carlyle that went public earlier. The listing framework of CVC Capital will reference the model of the Swedish investment firm EQT, where equity investors can share all management fee income, but most of the profits from private equity transactions will not be openly shared.

-

Previous

Ying Wei Da is at the top? Wall Street is looking at emerging markets: looking for the next Ying Wei Da.

Driven by global enthusiasm for artificial intelligence, BVP’s stock prices have tripled in less than a year, and have also led to a 50% rise in America’s major semiconductor producer’s index

-

Next

The stock price experienced its longest continuous decline since 2018, and safety concerns have raised market worries.

Since the deadly crash of the Boeing 737 Max aircraft in Indonesia in 2018, Boeing's stock price has once again suffered a heavy blow, showing its worst performance since then. Earlier this year

Related articles

- Puppets, Doo-Dou-Dou-Dou-Dou-Dou-Dou-Dou-Dou-Run-Han-Han-Han-Han-Han-Hu-Hu-Hu-Hu-Hu-U-U-M-U-M-U-U-U-U-W-W-W-W-W-W-W-W-W-W-W-W-W-W-W-W-W-W-W-W-W-W-W.

- The U.S. shares fell by 151 each night to announce a $20 million stock buyback plan.

- The weak sales of electric vehicles in North America has led to the downgrade of Sensata ST.US and ChargePoint CHPT.US ratings in Goldman Sachs.

- Fast-trackers increased their stock by 6.65% last week.

- Three shares point to a 12-percent increase in super-microcomputers on futures.

- The difference between the Hong Kong and the United States shares

- U.S. stock bounces back the chip and wins the big game, and the silver market sees the apples rise by over 3%.

- The three main shares indicate that the futures have gone up and down, and Aravive has fallen by almost 60%.

- Three major shares point to a 9% drop in ADM, the American agro-trade giant.

- The U.S. share fell by 163 during the night and Ali Baba responded that it was still an important asset.