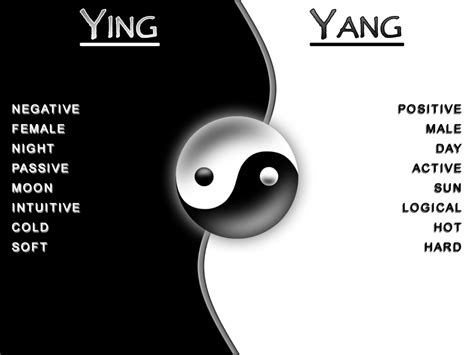

Ying Wei Da is at the top? Wall Street is looking at emerging markets: looking for the next Ying Wei Da.

Driven by global enthusiasm for artifi cial intelligence, BVP’s stock prices have tripled in less than a year, and have also led to a 50% rise in America’s major semiconductor producer’s index. And now, as some investors worry t

cial intelligence, BVP’s stock prices have tripled in less than a year, and have also led to a 50% rise in America’s major semiconductor producer’s index. And now, as some investors worry t h

h at BVD’s stock prices are high, Wall Street investors are turning their eyes to emerging markets in search of a “Next BV” with more investment value and growth potential.

at BVD’s stock prices are high, Wall Street investors are turning their eyes to emerging markets in search of a “Next BV” with more investment value and growth potential.

According to Jitania Kandhari, the Deputy Chief Investment Officer of the “Next Great Britain” Morgan Stanley Investment Management Company, Wall S treet, investors are increasingly looking for emerging market equities to replace the rising US share in science and technology.

In Wall Street, the Goldman Sachs Group’s asset management is looking specifically for shares of components manufacturers of artificial smart supply chains, such as cooling systems and power supply units; Mor

treet, investors are increasingly looking for emerging market equities to replace the rising US share in science and technology.

In Wall Street, the Goldman Sachs Group’s asset management is looking specifically for shares of components manufacturers of artificial smart supply chains, such as cooling systems and power supply units; Mor gan Chase Asset Management is more in favour of traditional electronics manufacturers that are transforming into AI leaders; and Morgan Stanley’s investment managers are betting that artificial intelligence is reshaping business models in the non-technology sector. The AIS stock has led to an increase of $1.9 trillion in the market value of emerging markets this year, with China’s Taiwan region and South Korea’s chip companies (e.g., power stations and SK Hercules) accounting for 90 per cent of the increase.

gan Chase Asset Management is more in favour of traditional electronics manufacturers that are transforming into AI leaders; and Morgan Stanley’s investment managers are betting that artificial intelligence is reshaping business models in the non-technology sector. The AIS stock has led to an increase of $1.9 trillion in the market value of emerging markets this year, with China’s Taiwan region and South Korea’s chip companies (e.g., power stations and SK Hercules) accounting for 90 per cent of the increase.

Despite a sharp upswing, most emerging market AI shares are still far below the 35-fold expected market gain for their counterparts in the United States – British Weida – while Asian artificial intelligence giants usually expect a 12- to 19-fold expected market gain. In addition, emerging markets provide faster growth rates.

-

Previous

Watch out, one night. It's gonna be tough for the A Unit next week.

First, when the United States jumped overnight, the three major indices of the United States fell across the board, down 1.24 per cent on their fingers, 1.62 per cent on their fingers, and 1.46 per

-

Next

CVC Capital will launch its IPO tomorrow, with a global asset management scale of 186 billion euros, making it the largest listed private equity firm in European history.

According to the Financial Times, European private equity group CVC Capital Partners is preparing to announce its initial public offering (IPO) plan as early as next Monday (tomorrow), kicking off

Related articles

- The US Corps dropped 2.84 percent last week.

- Mi Group dropped 7.58% last week.

- A total of 134 U.S. shares went up the other night, saying Ma Yun became the largest shareholder in Ali Baba.

- Ali Baba fell 1.6% of the stock in Hong Kong last week by 1.54%.

- Intel's release of an AI chip to challenge Yvetteda.

- Melon Bank, New York: The downside risk for the United States is a second wave of inflation.

- The New East Online stock rose by 9.23% last week, with a buy-in rating.

- All three are going up and down. Arm is going up and down by over 20%.

- At least eight new energy car brands have been promoted by Kryptsla, whose 185 Chinese share fell for less than 20 days the other night.

- The ideal car dropped 7.35% of the stock in Hong Kong last week by 6.52%.