The difference between the SPAC route to the United States and the traditional IPO

Since 2023, a number of Chinese enterprises and the United States company SPAC have completed their merger, including the future car parent company, China Crown, and the MMV. In addition, more than 10 Chinese enterprises are expected to complete their listing in the United States by borrowing the shell from the United States company SPAC.

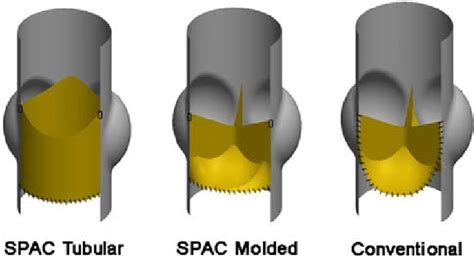

In particular, SPAC’s initiators set up shell companies to raise funds in NASDAQ or Newton's offices, and to search for firms to acquire assets within the agreed period of one to two years to complete the infusion, so that SPAC’s share price rises as assets are injected to the mutual benefit of the various participants. The nature of the SPAC’s listing can be summarized as first listed companies and then doing business. The ultimate objective of SPAC’s existence is to load operations through mergers and acquisitions within a certain period of time after IPO (usually two years) (the process of loading is known as De-SPAC).

As a result, SPAC is only a company that has no business and cash assets is the only asset before IPO is loaded. From the point of view of the business it is loaded, it achieves a listing purpose through De-SPAC’s dealings. De-SPAC deals are essentially private mergers and acquisitions by listed companies, for ex ample, in the United States, where transactions are still subject to scrutiny by the US CVM and exchange, but they are not subject to scrutiny as traditional IPOs.

ample, in the United States, where transactions are still subject to scrutiny by the US CVM and exchange, but they are not subject to scrutiny as traditional IPOs.

Under United States securities trading rules, the total market fair value of one or more of the acquired enterprises should be at least 80 per cent of the assets held in the trust account at the time of signing the first enterprise merger agreement (excluding deferred underwriting preferences and tax payable based on trust account income). In order to exercise reasonable control over the dilution of interests held by the originator and to make the De-SPAC transaction more attractive to the merger, SPAC usually chooses to merge enterprises that are four to eight times the size of its assets.

With regard to the financial statements, the CSRC commissioning agent rule requires the commissioning of a statement of vote (proxy status) to include financial statements for two to three years of merger or purchase, as well as interim financial statements. It is understood that Chinese firms prefer the SPAC method of listing in the United States, and that there are two other factors, namely, external environmental impacts and the fact that a number of Wall Street secondary market investment funds continue to opt for low- and medium-size shares, which has led many Chinese enterprises to fear that direct IPOs will not be able to achieve the expected level of fund-raising, compared with several US companies that raised hundreds of millions of dollars in previous years, or that Chinese firms and SPC companies have been able to raise more money in real terms than IPOs in order to achieve greater market access; and a number of Chinese enterprises have entered into IPO-to-pricing agreements with creative shareholders.

In order to avoid the failure of the IPOs, business owners need to be listed as soon as possible, so they prefer the ease with which SPAC’s listing in the United States can be facilitated. The SPAC investors who obtained SPAC units in the IPOs (including shares and shares recognition certificates) are redeemable, and, after publication of the merger and bid, they can opt to exercise the right to foreclosure if they are not satisfied with the merger bid, and ask SPAC to redeem the SPAC’s shares in their possession, in accordance with its investment cost plus a certain interest.

Moreover, SPAC investors, by exercising their right to foreclosure to recover their principal and interest, can also retain an equity certificate , thereby reaping the gains of the post-De-SPAC stock price increase. As a result, SPAC has created a structural advantage for early investors involved in SPAC IPOs.

, thereby reaping the gains of the post-De-SPAC stock price increase. As a result, SPAC has created a structural advantage for early investors involved in SPAC IPOs.

In terms of cost, the traditional IPO underwriting rate is about 5-7 per cent, while the SPAC has a maximum premium of only 5.5 per cent of the size of the issue, and only 2 per cent of it is paid for on the market, with the remaining 3.5 per cent and the collected funds deposited in a trust account until the end of the SPAC life cycle is paid to the underwriter. SPAC normally issues the Public Unions equity unit to public investors, with one common stock plus one second or three Warrants in a Unit, i.e., a certificate of title.

As a rule, 52 days after the SPAC is listed, the shares and Warrants will be separated for the transaction. When IPO raises funds, SPAC will be required within two years to join and purchase a business that wants to be listed. The merged SPAC will apply to the SEC US Securities and Exchange Commission for listing and complete listing.

The short reason is that the SPAC is not the operating company, thus avoiding lengthy due diligence and the limited amount of information to be disclosed in the SPAC’s registration statement. As a result, the sponsor of the SPAC IPO has a clear cost and time advantage over the traditional IPO.

A comparison between SPAC and IPO Traditional IPO modes of listing: companies need to complete the process of selecting intermediaries, submitting information to CSRCs and exchanges, road pricing, etc. SPAC forms of listing: target companies can only be listed if they are merged with listed s ubjects. Compared to traditional IPOs, SPAC listing patterns, which are characterized by speed of time, cost, simplicity of process, and assurance of financing.

ubjects. Compared to traditional IPOs, SPAC listing patterns, which are characterized by speed of time, cost, simplicity of process, and assurance of financing.

There are different answers to the question of SPAC’s relative advantages and disadvantages to traditional IPOs. The data show that there are still about 400 US SPAC companies with assets of about $100 billion that have not yet enter ed into a consolidated asset transaction, and that if the SPAC companies are unable to complete their asset injections within two to three years of their launch, they will only accept liquidation as they fall due – and will have to return the cash invested to the investors.

ed into a consolidated asset transaction, and that if the SPAC companies are unable to complete their asset injections within two to three years of their launch, they will only accept liquidation as they fall due – and will have to return the cash invested to the investors.

However, according to the 2022 Inflation Reduction Act issued by the United States, since 2023, if SPAC sponsors return cash to investors, an additional 1% of the consumption tax will have to be paid, resulting in SPAC sponsors not only being unprofitable, but also having to pay the consumption tax out of their own pocket. In this context, more and more US SPAC companies are competing to absorb Chinese firms into completing asset injections as soon as possible, in order to avoid the “complexity” of SPAC’s payments of the consumption tax due to its liquidation.

However, China’s firms need to show good performance and sound ability to operate if they are to gain the popularity of US capital markets when they go to the US. This makes the current Wall Street secondary market investment fund particularly “hard” for companies listed on the Wall Street market – not only a comprehensive assessment of whether firms have high profitability, but also a multi-dimensional examination of whether firms have strong resilience to the risks of economic volatility.

These Wall Street investment funds have lost a lot of money in SAC’s investments over the past three years because of the delay in making a profit from these companies and the fact that the price of the burning money (and the tight regulation of the encrypted digital asset transactions) has been retrenched. Many Chinese businesses are now confident that they will go to the US, and they are continuing to promote the listing of Shell SAC in the US, as a complement to the traditional IPO path, and that the SAC will always be an integral  part of the capital market.

part of the capital market.

-

Previous

A total of 134 U.S. shares went up the other night, saying Ma Yun became the largest shareholder in Ali Baba.

During the night, the three main shares of the United States dollar increased or declined by 0.08 per cent, the standard 500 index rose by 4868.55, the NASDAQ composite rose by 0.36 per cent, the 1

-

Next

Three shares of futures are rising by almost 10%.

The US shares are up by 0.22% on futures as of the release date, mainly in blue, and by 0.46% on the 500 index, and by 0.73% on the 100 index of NASDAQ, dominated by the Science and Technology Unit

Related articles

- The United States stock grew 7.04 per cent last week by 8.56 per cent.

- A total of 155 Chinese Generals fell by the end of the night to change the NASDAQ trading code to SOGP effective 25 January.

- For the second year in a row, did the Anson-Miss semiconductor ON.US surprise investors?

- Microsoft showed an increase of 1.8% in the US share last week, and Wells Fargo gave it a higher rating.

- The three main shares mean that futures will rise and fall by less than 3% for Tesla.

- In March, there was a thunderstorm on the U.S. banker's full-time return to the US in a fall-off fantasy.

- Meta increased US shares by 6.4% last week, and Mizuho gave a buy-in rating.

- The three major indices of the United States have gone up and down, and non-ferrous metals and mining have gone up and down.

- Buy and buy, SalesForce. Buy and buy.

- Biadi shares increased by 5.84% last week.